Grundläggande statistik

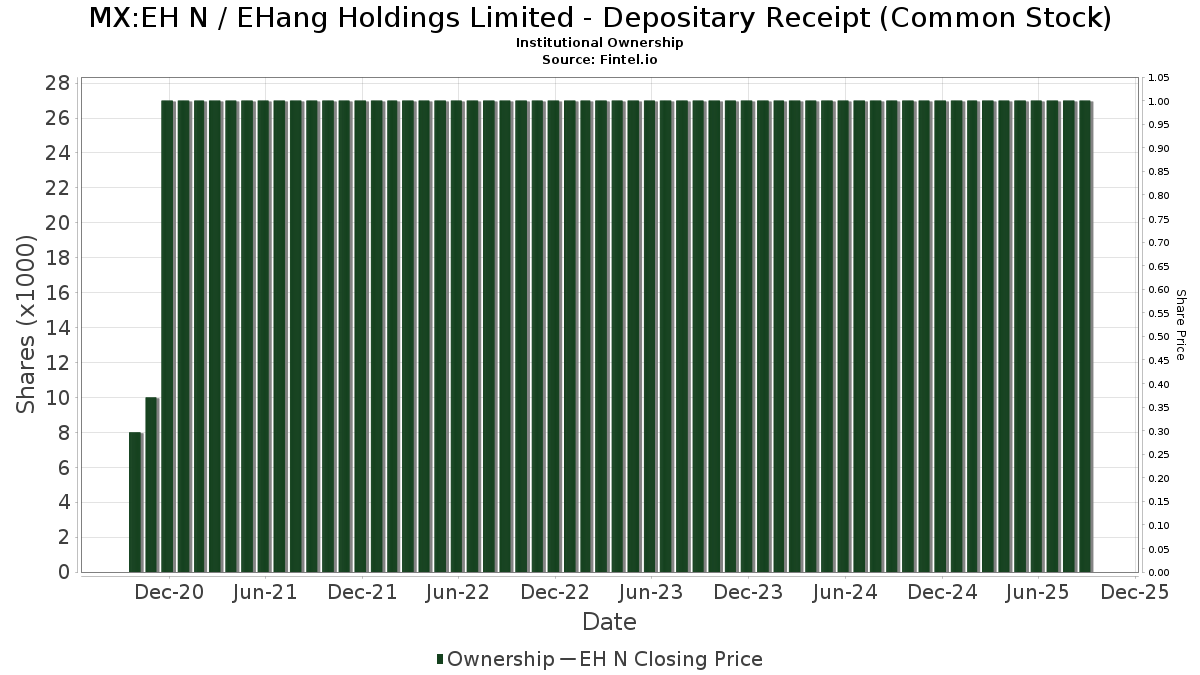

| Institutionella ägare | 106 total, 93 long only, 0 short only, 13 long/short - change of 75,00% MRQ |

| Genomsnittlig portföljallokering | 0.0003 % - change of 4 767,23% MRQ |

| Institutionella aktier (lång) | 13 666 374 (ex 13D/G) - change of 0,02MM shares 212,80% MRQ |

| Institutionellt värde (lång) | $ 231 827 USD ($1000) |

Institutionellt ägande och aktieägare

EHang Holdings Limited - Depositary Receipt (Common Stock) (MX:EH N) har 106 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 13,666,374 aktier. Största aktieägare inkluderar Axim Planning & Wealth, Vanguard Group Inc, Susquehanna International Group, Llp, Susquehanna International Group, Llp, KADENSA CAPITAL Ltd, State Street Corp, KOMP - SPDR S&P Kensho New Economies Composite ETF, Jane Street Group, Llc, Group One Trading, L.p., and UBS Group AG .

EHang Holdings Limited - Depositary Receipt (Common Stock) (BMV:EH N) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Millennium Management Llc | Put | 28 800 | −33,79 | 500 | −45,04 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 387 700 | −31,39 | 6 730 | −42,99 | |||

| 2025-05-20 | 13F/A | Lansdowne Partners (uk) Llp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 29 683 | −89,61 | 515 | −91,37 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | Call | 33 600 | 182,35 | 583 | 135,08 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 467 600 | 141,28 | 8 118 | 100,52 | |||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 3 500 | 61 | ||||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 155 860 | 22,37 | 2 706 | 1,69 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 7 292 | 10,13 | 127 | −8,70 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 940 800 | 241,61 | 16 332 | 183,89 | |||

| 2025-07-24 | 13F | IFP Advisors, Inc | 100 | 0,00 | 2 | −50,00 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 25 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 597 400 | −59,35 | 10 371 | −66,22 | |||

| 2025-08-14 | 13F | Sig Brokerage, Lp | Call | 13 700 | 238 | |||||

| 2025-07-22 | NP | GINN - Goldman Sachs Innovate Equity ETF | 9 535 | 155 | ||||||

| 2025-08-15 | 13F | WealthCollab, LLC | 20 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 20 980 | 217,30 | 364 | 163,77 | ||||

| 2025-06-27 | NP | PGJ - Invesco Golden Dragon China ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 41 420 | 11,37 | 694 | 9,83 | ||||

| 2025-08-14 | 13F | Electron Capital Partners, LLC | 35 919 | −0,23 | 624 | −17,15 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 4 241 | 69 | ||||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 58 101 | 1 009 | ||||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 35 634 | −24,37 | 618 | −37,13 | ||||

| 2025-08-13 | 13F | California Public Employees Retirement System | 50 338 | −3,25 | 874 | −19,61 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 290 900 | 3 061,96 | 5 050 | 2 530,21 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | 34 361 | −51,83 | 597 | −60,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 499 800 | 10,26 | 8 677 | −8,37 | |||

| 2025-06-30 | NP | VGTSX - Vanguard Total International Stock Index Fund Investor Shares | 590 191 | 0,00 | 9 886 | −1,42 | ||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Tsfg, Llc | 40 | 0,00 | 0 | |||||

| 2025-08-05 | 13F | Carrhae Capital LLP | 271 700 | 4 717 | ||||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 7 425 | −81,04 | 129 | −84,35 | ||||

| 2025-06-30 | NP | VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares | 539 778 | 0,00 | 9 041 | −1,41 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 13 499 | −92,26 | 234 | −93,57 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | Put | 1 400 | −79,71 | 24 | −83,33 | |||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 35 588 | −1,61 | 618 | −18,28 | ||||

| 2025-07-29 | NP | VSGX - Vanguard ESG International Stock ETF ETF Shares | 7 225 | 0,00 | 117 | −29,09 | ||||

| 2025-08-28 | NP | SPEM - SPDR(R) Portfolio Emerging Markets ETF | 40 170 | 1,94 | 697 | −15,31 | ||||

| 2025-05-15 | 13F | Engineers Gate Manager LP | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 5 103 | 87 | ||||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Legal & General Group Plc | 3 380 | 171,70 | 59 | 132,00 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | EWX - SPDR(R) S&P(R) EMERGING MARKETS SMALL CAP ETF | 31 865 | 0,00 | 553 | −16,84 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 728 068 | −14,61 | 12 639 | −29,04 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 10 040 | −11,93 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 251 | 42,61 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 25 305 | 0,00 | 410 | −29,43 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 25 409 | −59,41 | 441 | −66,26 | ||||

| 2025-06-27 | NP | EVAV - Direxion Daily Electric and Autonomous Vehicles Bull 2X Shares | 5 533 | −37,00 | 93 | −38,26 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 3 549 | −16,12 | 0 | |||||

| 2025-08-13 | 13F | Centiva Capital, LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | Call | 10 000 | 174 | |||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 1 847 | 28,00 | 32 | 10,34 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | Put | 11 000 | 191 | |||||

| 2025-06-23 | NP | UGPIX - UltraChina ProFund Investor Class | 1 891 | −30,20 | 32 | −32,61 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 124 848 | 2 738,10 | 2 167 | 2 281,32 | ||||

| 2025-07-24 | NP | ONEQ - Fidelity Nasdaq Composite Index Tracking Stock This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 16 893 | 274 | ||||||

| 2025-08-22 | NP | FDRV - Fidelity Electric Vehicles and Future Transportation ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1 304 | 2 456,86 | 23 | 2 100,00 | ||||

| 2025-08-05 | 13F | Eleva Capital SAS | 46 336 | 804 | ||||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 67 | 81,08 | 1 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 253 100 | −28,40 | 4 | −42,86 | |||

| 2025-08-05 | 13F | Simplex Trading, Llc | 106 291 | −11,57 | 2 | −50,00 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 80 163 | 88,91 | 1 392 | 57,00 | ||||

| 2025-08-07 | 13F | Mitsubishi UFJ Kokusai Asset Management Co., Ltd. | 59 567 | −18,60 | 1 034 | −32,33 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | Call | 33 500 | 81 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | Put | 24 700 | 60 | |||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Lighthouse Investment Partners, LLC | 62 122 | −40,39 | 1 078 | −50,48 | ||||

| 2025-05-30 | NP | CGRO - CoreValues Alpha Greater China Growth ETF | 11 513 | 241 | ||||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Canada Pension Plan Investment Board | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 777 | 536,89 | 13 | 550,00 | ||||

| 2025-08-14 | 13F | Eschler Asset Management LLP | 200 000 | 1 329,80 | 3 472 | 1 089,04 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 38 319 | 1 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 838 763 | 10,16 | 14 561 | −8,46 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 45 | 0,00 | 1 | |||||

| 2025-08-28 | NP | HAIL - SPDR S&P Kensho Smart Mobility ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 18 495 | −23,20 | 321 | −36,18 | ||||

| 2025-08-14 | 13F | Man Group plc | 79 789 | 138,71 | 1 385 | 98,42 | ||||

| 2025-07-17 | 13F | Independence Bank of Kentucky | 150 | 0,00 | 3 | −33,33 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 62 549 | −31,29 | 1 086 | −42,92 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-12 | 13F | Virtu Financial LLC | 35 505 | 1 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 77 | −87,38 | 1 | −91,67 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 8 300 | −98,29 | 144 | −98,58 | |||

| 2025-08-14 | 13F | Peak6 Llc | Call | 402 000 | −12,55 | 6 979 | −27,34 | |||

| 2025-06-30 | NP | VFSNX - Vanguard FTSE All-World ex-US Small-Cap Index Fund Institutional Shares | 130 917 | −7,85 | 2 193 | −9,16 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 61 596 | 1 069 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 32 144 | −91,81 | 558 | −93,19 | ||||

| 2025-08-13 | 13F | Norges Bank | 441 782 | 7 669 | ||||||

| 2025-08-28 | NP | KOMP - SPDR S&P Kensho New Economies Composite ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 948 949 | 7,91 | 16 474 | −10,32 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 10 | 0 | ||||||

| 2025-08-14 | 13F | Ubs Oconnor Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Turim 21 Investimentos Ltda. | 501 | 0,00 | 9 | −20,00 | ||||

| 2025-08-13 | 13F | Natixis | 2 051 | −12,09 | 36 | −28,57 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 17 073 | 300 | ||||||

| 2025-08-14 | 13F/A | Bank Julius Baer & Co. Ltd, Zurich | 1 002 | 13,35 | 17 | −15,00 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 25 350 | −41,80 | 440 | −51,60 | ||||

| 2025-08-18 | 13F/A | Nomura Holdings Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Skopos Labs, Inc. | 70 | 0,00 | 1 | 0,00 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-03-27 | NP | TLTE - FlexShares Morningstar Emerging Markets Factor Tilt Index Fund | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | State Street Corp | 1 044 584 | 6,30 | 18 134 | −11,67 | ||||

| 2025-06-30 | NP | VT - Vanguard Total World Stock Index Fund ETF Shares | 23 884 | 4,94 | 400 | 3,63 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 39 202 | −5,12 | 681 | −21,21 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 149 980 | 110,99 | 2 604 | 75,40 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 73 191 | −41,81 | 1 271 | −51,66 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 203 600 | 51,49 | 3 534 | 25,90 | |||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | Put | 12 100 | 210 | |||||

| 2025-08-14 | 13F | Caption Management, LLC | Call | 103 200 | 1 792 | |||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 11 994 | 0 | ||||||

| 2025-08-06 | 13F | Axim Planning & Wealth | 4 398 242 | 0,10 | 76 353 | −16,81 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 6 528 | 3 147,76 | 113 | 2 725,00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 29 378 | 1 386,74 | 510 | 1 143,90 | ||||

| 2025-05-07 | 13F | Mackenzie Financial Corp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-23 | 13F | Steel Peak Wealth Management LLC | 49 354 | 857 | ||||||

| 2025-08-14 | 13F | KADENSA CAPITAL Ltd | 1 063 937 | 40,14 | 18 470 | 16,46 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 44 378 | −13,35 | 770 | −27,97 | ||||

| 2025-07-18 | 13F | Robeco Institutional Asset Management B.V. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | National Bank Of Canada /fi/ | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Hel Ved Capital Management Ltd | 245 431 | 302,35 | 4 261 | 234,38 | ||||

| 2025-05-15 | 13F | Point72 (DIFC) Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Carmignac Gestion | 106 479 | −11,64 | 1 848 | −26,58 | ||||

| 2025-08-28 | NP | GXC - SPDR(R) S&P(R) CHINA ETF | 7 159 | −10,21 | 124 | −25,30 | ||||

| 2025-08-12 | 13F | DnB Asset Management AS | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 70 | 0,00 | 0 | |||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 46 723 | 811 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 27 018 | 5 904,00 | 469 | 5 111,11 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 68 517 | 85,67 | 1 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 34 381 | 1 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 1 420 400 | 82,22 | 24 658 | 51,43 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 1 112 500 | 47,43 | 19 313 | 22,52 | |||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 27 099 | 470 | ||||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 27 131 | 0,98 | 471 | −16,22 | ||||

| 2025-08-14 | 13F | Numerai GP LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 21 | 5,00 | 0 | |||||

| 2025-07-16 | 13F | ABS Direct Equity Fund LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 12 009 | 133,64 | 208 | 94,39 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 21 241 | 369 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 1 966 797 | 18,87 | 34 144 | −1,22 | ||||

| 2025-05-23 | 13F | SWAN Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 76 177 | −69,01 | 1 322 | −74,26 | ||||

| 2025-07-10 | 13F | Baader Bank INC | 25 000 | −79,17 | 434 | −82,68 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 138 995 | −63,67 | 2 413 | −69,82 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 882 100 | −39,69 | 15 313 | −49,88 | |||

| 2025-08-12 | 13F | Rhumbline Advisers | 1 643 | −15,61 | 29 | −30,00 |

Other Listings

| US:EH | 16,40 US$ |